There are more than two million small businesses in Australia, and many of those are eligible for an annual small business tax offset.

But what is this offset, how do you know if you’re eligible, and how do you claim it if you are?

Here’s a quick explanation of everything you need to know about this initiative.*

What is a small business tax offset?

A small business tax offset is sometimes also known as the unincorporated small business tax discount, and it’s designed to give Australia’s smaller companies a helping hand at tax time each year.

Those eligible can see a reduction of their tax bill by as much as $1,000 per year with this offset.

Note that this can be applied to small businesses or to sole traders, and to those who have a share of an unincorporated small business’ income as part of their assessable income (a partnership or trust, for example).

The offset you receive is determined by two factors.

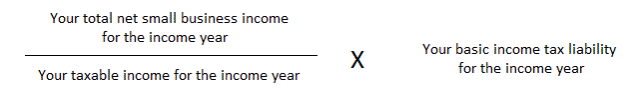

To start, you must divide your net small business income by your taxable income for the year. Then, multiply this result by your basic income tax liability, as seen in the image below.

The offset is the percentage of your net small business income divided by the result of taxable income multiplied by basic income tax liability.

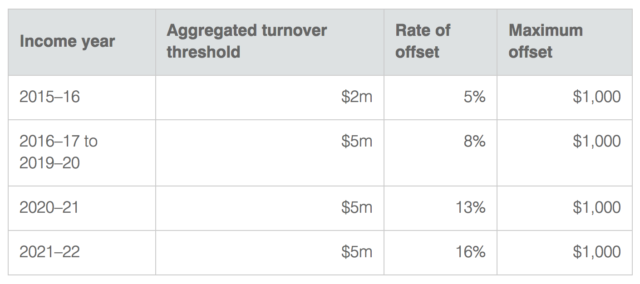

The second factor is a percentage, determined by the tax year. Your offset is the appropriate percentage of the result of the above equation.

See the table below from the ATO for that percentage by year, and note that any offsets are capped at $1,000 per tax year.

Is your company eligible for the small business tax offset?

Even though this offset is one of the most popular small business tax deductions, not all companies and sole traders will be eligible for the offset.

To be eligible for these annual small business tax concessions, your net company income must be under $5 million. If you’re looking to claim all the way back to tax year 2015-2016, the threshold is lower at $2 million.

How to claim the small business tax offset.

One of the best parts of the offset is claiming it is very simple. In fact, you don’t actually have to take any special steps at all.

When you lodge your tax return, the Australian Tax Office (ATO) will automatically calculate your offset based on the figures you enter into your return.

This is true whether you do your own taxes with the myTax tool, or if you have a professional accountant working on your behalf.

You can also use the small business income tax offset calculator to determine your income amounts, so you know exactly which figures you must enter and where.

Keep in mind that this calculator does not determine your actual tax offset – it simply helps with entering the correct figures on your return. The actual calculation of your offset will be processed with your tax return after you have submitted it.

You will then be shown your tax offset amount on your final Notice of Assessment from the ATO.

Small business tax in Australia can be a challenge, especially for those new to operating their own company. However, with helpful deductions such as the offset, there are ways to minimise the amount you pay in taxes (legally!).

Need a hand with your financial records?

It’s vital to stay on top of your customer invoicing and payments in order to submit an accurate tax return. A CRM system like Thryv, that includes invoicing capabilities, makes this easier, allowing you to file all your customer info in the one place, from payments to personal details. So when you’re ready to do your tax, it’s much easier to find the information you’ll need to get the best return possible.

*We endeavour to provide accurate material for Australian businesses consistent with Australian tax laws; however, this material is for reference only and is not designed to be, nor should it be regarded as professional advice.